Investment Platforms

Retail Platforms

Investment platforms allow for a modern, efficient and consolidated approach to managing your pension and investment products. Our preferred platforms are all primarily based online with user-friendly client websites, excellent customer service and cost-effective provider charges. These platforms provide an easy way to monitor and manage various products, and their investments, under one umbrella for simple administration.

These platforms are targeted at our UK clients who would like to hold their investments within wrapped products such as a pension, bond or stocks & shares ISA which can offer hugely beneficial tax efficient environments. There are a variety of different products and investment options available that we can suggest depending on your requirements.

We appreciate it can be difficult to keep track of pensions and accounts that are accrued during a lifetime, so we partner with these platforms to help you keep your wealth organised and easily accessible. Within a review with our financial advisers, we will assess the potential benefits and disadvantages in transferring your individual products to a platform so you can decide what will work best for you moving forward.

At A&J, we are often able to negotiate discounted terms and restricted share classes for our clients so we can help reduce fees and add as much benefit as we possibly can. We review our recommended platforms on an annual basis to ensure we are always providing our clients with the best advice in their interests and recommending solutions that we trust will be advantageous to you.

Benefits of a platform include:

A single view of your portfolio value across different products

Access to consolidated, online valuations

A secure access point for adding, switching or withdrawing funds

A wide range of investment choices, covering all the main asset classes

Tax efficient product wrappers

Financial News

Monthly Update: April 2024

3rd April 2024 Global Outlook In the UK, inflation surprised by coming in lower than expected, putting pressure on the Bank of England to cut

Letter from CEO – Gareth Jones

25th March 2024 Letter from CEO – Gareth Jones Dear Sir/Madam, Since 1985, I have been committed to providing an excellent service to all our

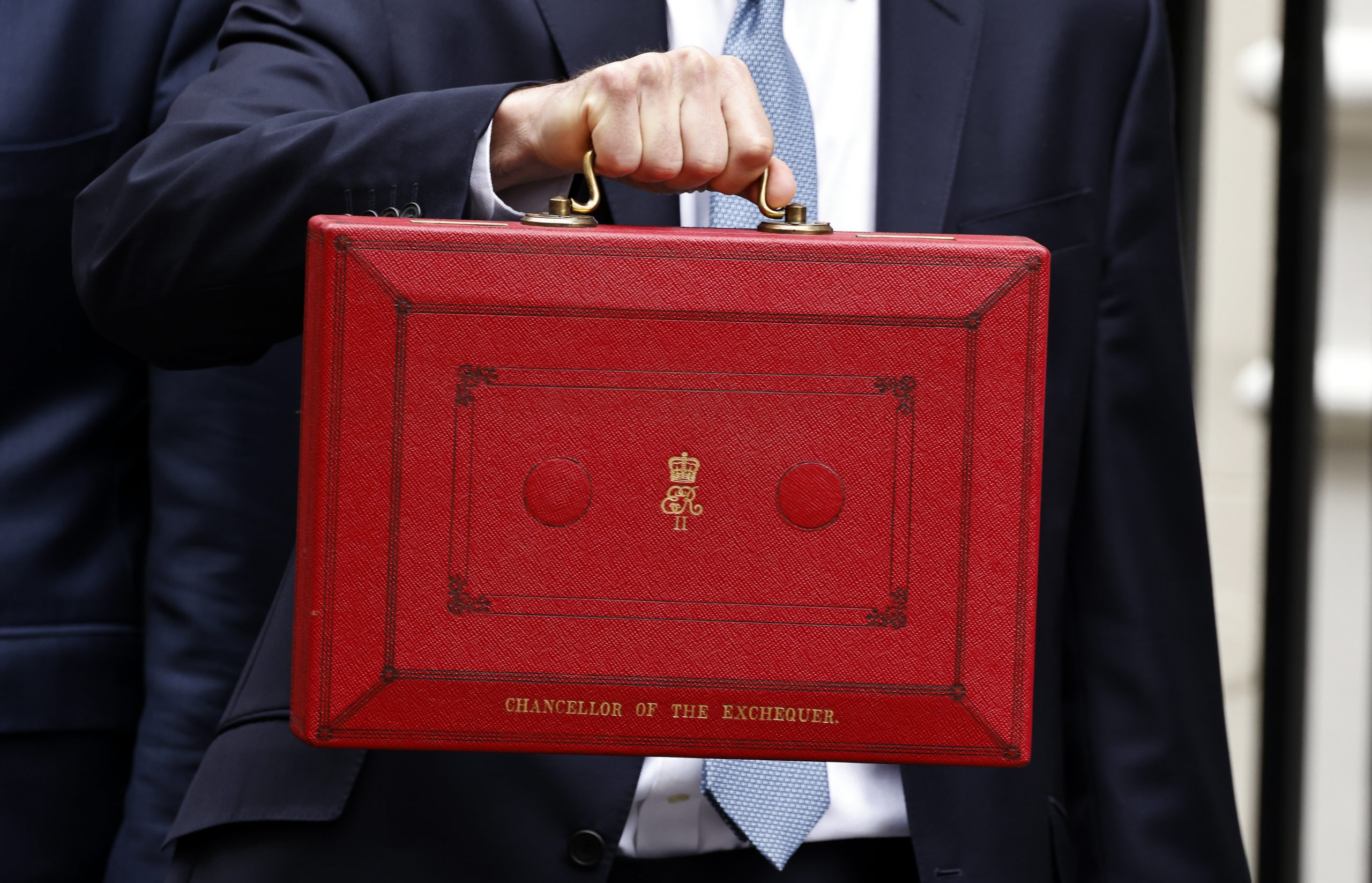

Spring 2024 Budget Guide

8th March 2024 Spring 2024 Budget Guide On Wednesday, 6 March, Jeremy Hunt, the Chancellor of the Exchequer, addressed the Commons to deliver the Spring

Monthly Update: March 2024

5th March 2024 Global Outlook The Magnificent Seven continued to rally with NVIDIA leading the charge. Microsoft, Google parent Alphabet, Amazon, Apple, Meta, NVIDIA, and

Get In Touch

Leave us a message

A&J Wealth Management Ltd

Sawfords

Bigfrith Lane

Cookham Dean

Berkshire

SL6 9PH

01628 480200

enquiry@ajwealth-management.com

Phone:

01628 480 200

Email:

enquiry@ajwealth-management.com

Address:

Sawfords,

Bigfrith Lane,

Cookham Dean,

Berkshire,

SL6 9PH

© 2024 A&J WEALTH MANAGEMENT LTD A&J Wealth Management Ltd is authorised and regulated by the Financial Conduct Authority. Financial Services Register, no 428590, at www.fca.org.uk/register Registered in England, Company no: 5105933. Registered Head Office: Sawfords, Bigfrith Lane, Cookham Dean, Maidenhead, Berkshire SL6 9PH