Becoming A Client

Our Process

When you engage an A&J Wealth Management financial adviser to help with your financial decisions, the first thing we do is undertake a consultation.

This 'getting to know you' phase is a four-stage process, the result of which is a personally tailored recommendation report and support in execution of your financial plan.

Once in place, we keep an eye on things for you, providing regular reviews and updates to ensure your plans stay on track.

The 4 Steps to Becoming A Client

Before we can undertake any kind of research to your behalf, we need to know more about you: your current financial situation, your dependents (if any), your aspirations and your goals.

For most clients, this involves sitting down somewhere comfortable and simply talking about what is important to you, what you want to achieve.

During that process, your financial adviser will take quite a lot of notes, all of which will then be taken away and used to help formulate your plan.

Based on your responses to the various questions you answer and discussions you have, our researchers will then work with your adviser to build a personalised financial planning report.

That report will include:

An outline of your current situation

Consideration of your income, assets and liabilities

A risk profile, used to determine what assets would be suitable for investment

A summary of your financial aspirations and desires

Our detailed recommendation report – what we suggest you do now and details of the type of product that would be suitable

Our future considerations report – what we suggest you might like to think about later, as your financial position develops.

That report is then yours for reference and how you proceed with it is up to you. You will be under no obligation to carry out any of the recommendations – and even if you do, there is no obligation to use A&J Wealth Management.

Should you decide you would like to implement some or all of the financial advice recommendations, A&J Wealth Management will facilitate the full details for you and organise the information you need to progress.

First we will issue details of the specific products we recommend to meet your needs. Details will be sent to you along with a summary of the reasons why and any application forms that require completion and/or signature.

On receipt of the required paperwork, we will then deal directly with the various providers to get your money invested and your products up and running as quickly as possible.

The vast majority of our clients ask us to take on the monitoring of their investments for them. This means that the responsibility for reviewing fund managers, measuring performance and informing you when changes may be required is handled by A&J Wealth Management.

Our reviews involve regular updates on how your investments are performing, what gains and/or losses have been incurred on each chosen fund and updates on what is and has been affecting different market sectors. In the background, our Investment Committee keeps an eye on the wider investment community to see if there are any funds that ought to be included, switched – or removed – from your portfolio.

A&J Wealth Management clients can if they wish, subscribe to our regular e-newsletters and latest opinions can also be found on our finance newsfeed.

Planning Your Strategy

Of all the questions your adviser will ask you, risk is probably the most important. If you have a lower tolerance to risk, and are worried about the effect a significant fall in equities might have, the more you will likely have invested in assets such as bonds or even cash. These can act as protection against loss when equities do fall.

On the other hand, if you have a high tolerance of risk, you will be able to weather falls in the value of your portfolio in pursuit of your goal – this will likely mean you have a higher exposure to equities.

Time is also important. If your timeline is relatively short, or if you are reviewing long term holdings in the final years before retirement, even with a higher tolerance of risk, you may start to decrease the amount you hold in equities. This helps to consolidate the value you have achieved and reduces the chances of losing those hard won savings just when you finally need them.

Visit our knowledge centre to find out about the different asset classes.

Financial News

Monthly Update: April 2024

3rd April 2024 Global Outlook In the UK, inflation surprised by coming in lower than expected, putting pressure on the Bank of England to cut

Letter from CEO – Gareth Jones

25th March 2024 Letter from CEO – Gareth Jones Dear Sir/Madam, Since 1985, I have been committed to providing an excellent service to all our

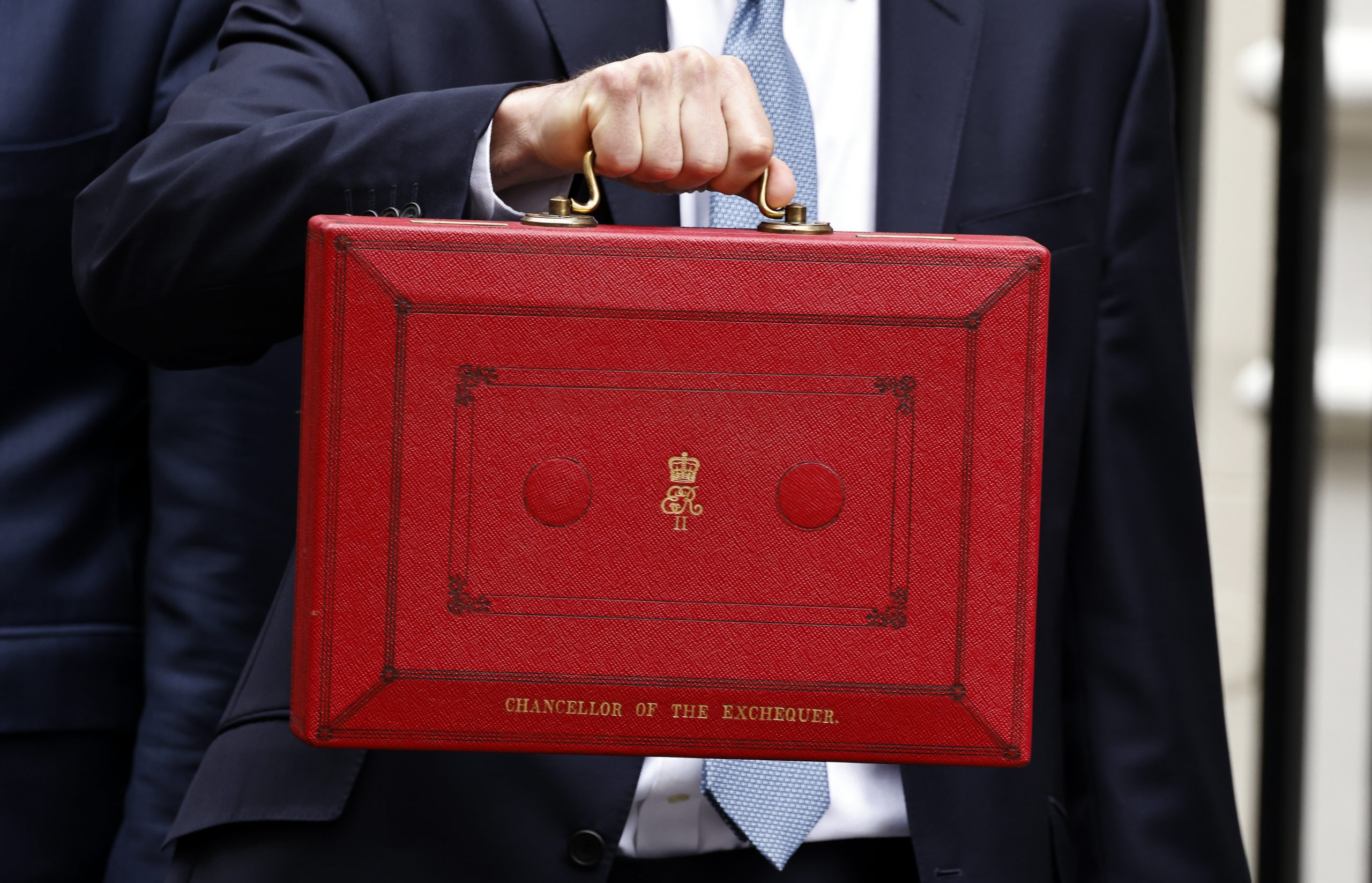

Spring 2024 Budget Guide

8th March 2024 Spring 2024 Budget Guide On Wednesday, 6 March, Jeremy Hunt, the Chancellor of the Exchequer, addressed the Commons to deliver the Spring

Monthly Update: March 2024

5th March 2024 Global Outlook The Magnificent Seven continued to rally with NVIDIA leading the charge. Microsoft, Google parent Alphabet, Amazon, Apple, Meta, NVIDIA, and

Get In Touch

Leave us a message

A&J Wealth Management Ltd

Sawfords

Bigfrith Lane

Cookham Dean

Berkshire

SL6 9PH

01628 480200

enquiry@ajwealth-management.com

Phone:

01628 480 200

Email:

enquiry@ajwealth-management.com

Address:

Sawfords,

Bigfrith Lane,

Cookham Dean,

Berkshire,

SL6 9PH

© 2024 A&J WEALTH MANAGEMENT LTD A&J Wealth Management Ltd is authorised and regulated by the Financial Conduct Authority. Financial Services Register, no 428590, at www.fca.org.uk/register Registered in England, Company no: 5105933. Registered Head Office: Sawfords, Bigfrith Lane, Cookham Dean, Maidenhead, Berkshire SL6 9PH