Service Options

Wealth Management Services To Suit Your Needs

We offer a number of different wealth management service options depending on your requirements. Whether you’re after a full financial planning service with advice relating to pensions and protection, investment management recommendations from an experienced investment team, or both, we’ll have a package that suits you. We have outlined below our key service options, though please do get in touch to find out which may suit you best.

Financial Planning with Discretionary Fund Management

This service is designed for customers wishing to access our financial advisers for holistic advice in planning for their future, and outsource their portfolio management completely to an expert Investment Committee. This service includes:

- A Personal Financial Planning Consultation

- Holistic Financial Recommendation Report

- Support through Implementation of Agreed Investments

- Automatic Fund Adjustments through Model Portfolios

- Access to our Investment Committee

- Quarterly Portfolio Statements

- Monthly E-Newsletters

- Regular Risk Assessments

- Annual Review Meetings

Similar to the Financial Planning with Discretionary Fund Management (DFM) service described above, this package includes access to a fully qualified financial planner. In addition, you will also have an experienced investment manager to cater to specific portfolio requests and tailor chosen investments to your requirements. This service includes:

- A Personal Financial Planning Consultation

- Holistic Financial Recommendation Report

- Support through Implementation of Agreed Investments

- A Dedicated Investment Manager

- Customised Investment Portfolio

- Automatic Fund Adjustments

- Access to our Investment Committee

- Quarterly Portfolio Statements

- Monthly E-Newsletters

- Regular Risk Assessments

- Annual Review Meetings

Financial Planning with Advisory Fund Management

For clients looking to maintain control over their investment selection, we offer an advisory service where we will provide recommendations on a regular basis for customers to review, in addition to full financial planning advice.

Silver

Our Silver service is designed for those with straight forward needs who would like their investments reviewed on an annual basis. This service includes:

- Dedicated Financial Adviser

- Personal Financial Planning Consultation

- Holistic Financial Recommendation Report

- Support through Implementation of Agreed Investments

- Annual Investment Recommendations

- Annual Portfolio Statements

- Monthly E-Newsletters

- Regular Risk Assessments

- Annual Suitability Review

Gold

Our Gold service is designed for those people looking for involved advice who would like their investments reviewed on a half yearly basis. This service includes:

- Dedicated Financial Adviser

- Personal Financial Planning Consultation

- Holistic Financial Recommendation Report

- Support through Implementation of Agreed Investments

- Half-Yearly Investment Recommendations

- Half-Yearly Portfolio Statements

- Monthly E-Newsletters

- Regular Risk Assessments

- Annual Review Meetings

Platinum

Our Platinum service is designed for people with complex requirements who would like their investments reviewed on a quarterly basis. This service includes:

- Dedicated Financial Adviser

- Personal Financial Planning Consultation

- Holistic Financial Recommendation Report

- Support through Implementation of Agreed Investments

- Quarterly Investment Recommendations

- Quarterly Portfolio Statements

- Monthly E-Newsletters

- Regular Risk Assessments

- Annual Review Meetings

As part of your consultation we can help you decide which option would be best for your situation, give us a call to be introduced to one of our expert financial advisers and let us give your money a helping hand.

We will provide our charges for these services as part of our initial discussion.

Please make sure you’re aware of the risks involved with investing before taking financial advice; have a look at our important information found here.

Financial News

Monthly Update: April 2024

3rd April 2024 Global Outlook In the UK, inflation surprised by coming in lower than expected, putting pressure on the Bank of England to cut

Letter from CEO – Gareth Jones

25th March 2024 Letter from CEO – Gareth Jones Dear Sir/Madam, Since 1985, I have been committed to providing an excellent service to all our

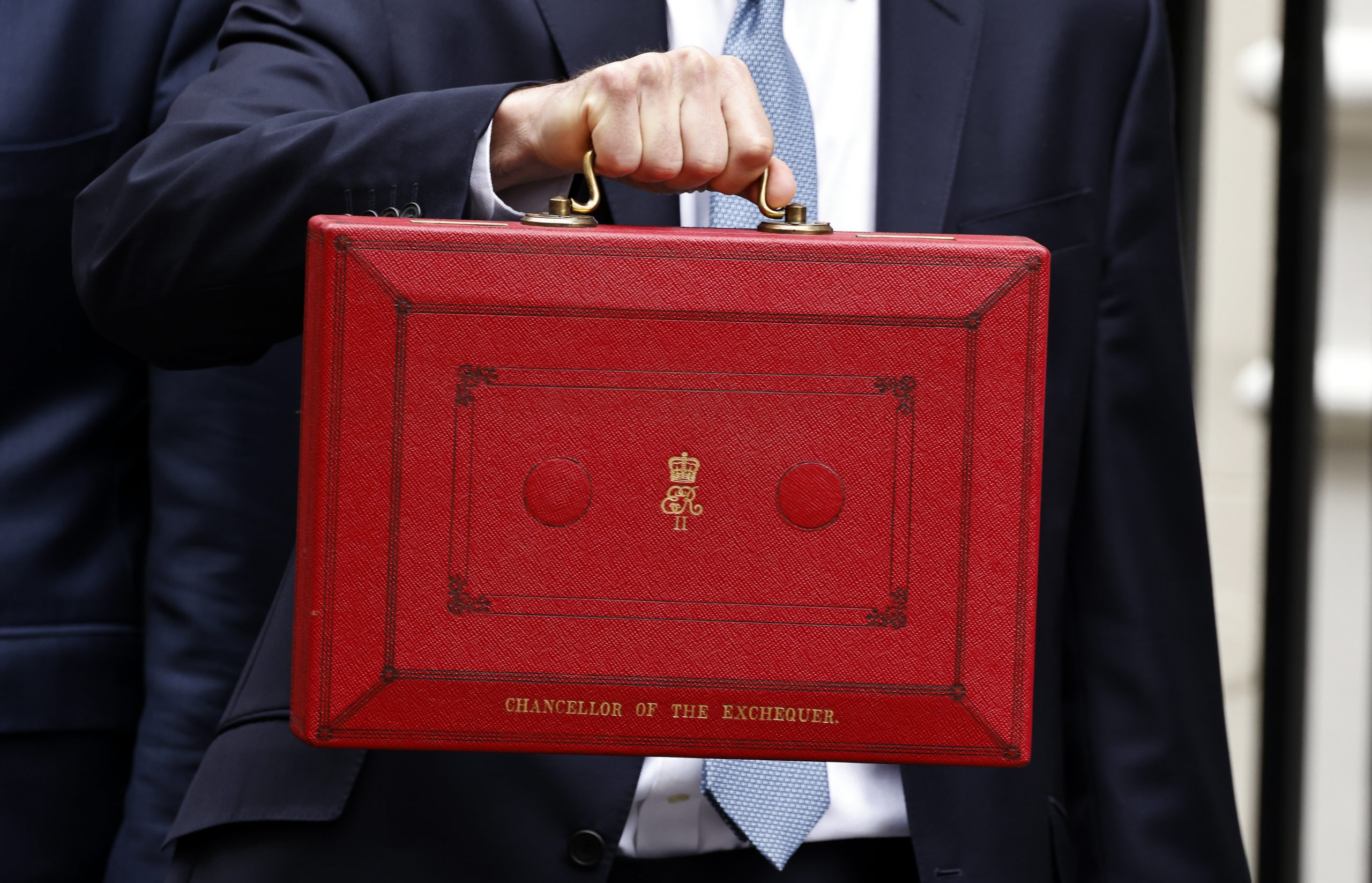

Spring 2024 Budget Guide

8th March 2024 Spring 2024 Budget Guide On Wednesday, 6 March, Jeremy Hunt, the Chancellor of the Exchequer, addressed the Commons to deliver the Spring

Monthly Update: March 2024

5th March 2024 Global Outlook The Magnificent Seven continued to rally with NVIDIA leading the charge. Microsoft, Google parent Alphabet, Amazon, Apple, Meta, NVIDIA, and

Get In Touch

Leave us a message

A&J Wealth Management Ltd

Sawfords

Bigfrith Lane

Cookham Dean

Berkshire

SL6 9PH

01628 480200

enquiry@ajwealth-management.com

Phone:

01628 480 200

Email:

enquiry@ajwealth-management.com

Address:

Sawfords,

Bigfrith Lane,

Cookham Dean,

Berkshire,

SL6 9PH

© 2024 A&J WEALTH MANAGEMENT LTD A&J Wealth Management Ltd is authorised and regulated by the Financial Conduct Authority. Financial Services Register, no 428590, at www.fca.org.uk/register Registered in England, Company no: 5105933. Registered Head Office: Sawfords, Bigfrith Lane, Cookham Dean, Maidenhead, Berkshire SL6 9PH