9th November 201

Climate Change - Can Investors Do Anything?

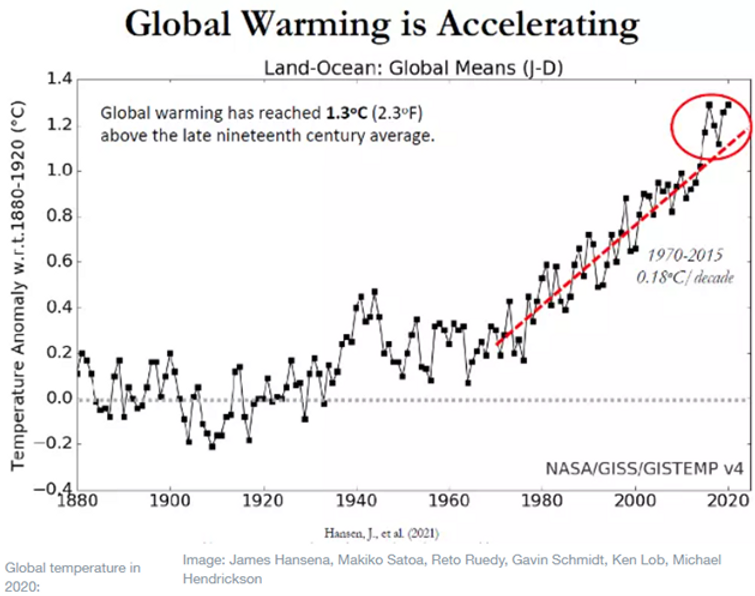

By 2050, the earth’s population is expected to pass 9 billion, and by 2100climate models predict sea levels will be 0.7m higher than now. The effects ofhuman-induced climate change are there for all to see and becoming evermore obvious. Summer heatwaves, wildfires, widespread droughts, rising sealevels, floods, and the frequency in which these events occur can no longer beignored or dismissed. Global temperatures have now reached all-time highsand are projected to rise further still. The graph below shows the sheer scale ofthe issue in comparison to past ‘normal’ levels.

Virtually everyone agrees that action needs to be taken, and this is now becoming a major part of most listed companies’ strategic direction as scrutiny of their sustainability policies is increasing.

Importantly for us, climate change presents an incredible opportunity to both profit and also affect change in the world. 86% of investors see climate change as a key theme in their portfolios by 2023, a huge increase in only 2 years ago when only a third put climate change at the centre of their investment strategy. We believe we are also part of the climate solution by investing in companies that make a difference.

Tackling climate change must be a multi-pronged approach, given the sheerscale of the issue and that every aspect of human life contributes eitherdirectly or indirectly. This is where climate change splits into several themesworth exploring in more detail. Clean energy is perhaps the most obvious. Steps to move towards renewables are progressing but not fast enough. 80% of the world’s energy supply still comes from fossil fuels, and with the growing energy demands in emerging economies such as China it is actually forecast to rise to 82% by 2030. It will take a substantial effort to lower this even asdeveloped countries are committing to so-called net-zero over the comingdecades.

Various governments have made strides in helping companies to offset theircarbon footprint. The European Union introduced a carbon credit scheme known as the EU Emissions Trading System (ETS), which mandates companies in certain sectors to buy a pre-determined number of carbon credits. The EUETS works on the ‘cap and trade’ principle, whereby a cap is set on the totalamount of certain greenhouse gases that can be emitted. The cap is reduced over time so that the total emissions falls. Within the cap, companies buy or receive allowances which they can then trade with one another as needed, meaning companies that need more credits to offset a higher carbon foot print can buy from those who have a lower carbon footprint than anticipated.

Sustainable nutrition must also be at the forefront of the drive towards a cleaner climate. Continued improvements in agricultural practices, such as using land more efficiently, is essential to producing the required quantity of food and especially so considering the expanding global population. Soil, for example, is an essential resource for 95% of all food that we produce, but 33% of soil has been degraded due to bad practices, and this is not so easily reversed.

In recognising the importance of this theme, A&J have been exploring how our clients might benefit from this trend in environmentally sustainable investing.We have recently approved the new JP Morgan Climate Solutions fund and will be incorporating it into our model portfolios in the near future. The fund seeks to invest in companies which are engaged in the move towards a cleaner climate, something the fund calls “climate enablers.” These are companies that are actively pivoting their businesses away from harmful practices and/or that are directly contributing to helping fight climate change via innovation. For example, Volkswagen is perhaps a company most would assume is not particularly at the cutting edge of the shift to a more sustainable word. However, Volkswagen is the largest car manufacturer on the planet and will soon overtake Tesla as the largest producer of electric vehicles. The company is investing billions to position itself away from existing combustion engines and towards more efficient and cleaner powered vehicles.

Tackling climate change will require a huge effort from every individual and corporation. We as investors must take the initiative in allocating capital towards those companies that most stand to elicit change and away from those that are just not improving fast enough or even making the effort at all. The onus is on each of us to make the difference, now more than ever.

Disclaimer:

The opinions expressed in this update are those of A&J Wealth Management Limited only, as at 9th November 2021, and are subject to change.

The content of this publication is for information purposes and should not be treated as a forecast, research or advice to buy or sell any particular investment or to adopt any investment strategy. It does not provide personal advice based on an assessment of your own circumstances. Any views expressed are based on information received from a variety of sources which we believe to be reliable but are not guaranteed as to accuracy or completeness. Any expressions of opinion are subject to change without notice.

The tax treatment depends on your individual circumstances and may be subject to change in future.

Past performance is not a reliable indicator of future results. Investing involves risk and the value of investments, and the income from them, may fall as well as rise and are not guaranteed. Investors may not get back the original amount invested.

In addition to statements provided by A&J, you will receive regular account valuations from your product provider which should be read in conjunction with our reports and will include further details such as fees and transactions. You will also receive information about your plan annually with itemised charges. A more detailed breakdown of fees can be provided upon request, where relevant.