31st December 2022

Can Energy Stocks Keep Going?

Energy stocks had a big 2021, gaining the most of any sector globally andending the year up nearly 35%. Persistent concerns about inflationary pressuresbegan to finally seep through as inflation data was published.

Energy consumption is picking up as economies are continuing to reopen. While the supply side has been extremely disciplined over last 5 years, with OPEC keeping low production levels, OPEC’s crude production has risen steadily since the June 2020 lows. From April to August 2021, supply has increased by around 1.8m barrels per day. However, tanker shipments suggest that much of this additional supply is not reaching the export market, pointingtowards sharply rising domestic demand within OPEC itself, leaving non-OPEC consumers (much of the developing world) facing an increasingly tight energy market.

The macroeconomic backdrop is positive for energy stocks. The continued pickup in global economic activity coupled with the high inflation prints and forecast interest rate rises are perfect conditions for energy to continue its outperformance into 2022. Central banks are signalling clear intentions to begin tapering their quantitative easing programmes, interest rates are forecastto rise, with the bank of England having already made the first move, and the global economy will continue its recovery from the ongoing coronavirus crisis.

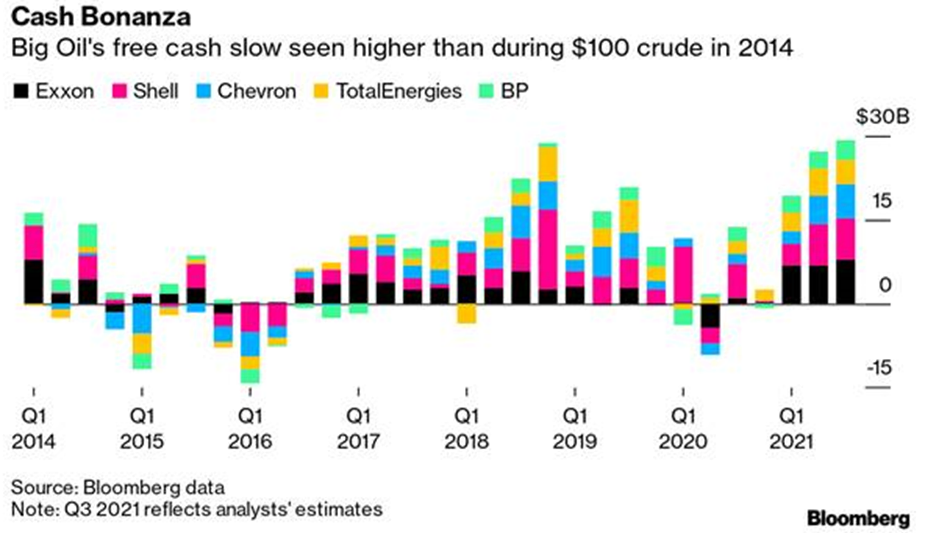

Energy companies themselves also look incredibly attractive, with favourable commodities process, healthy balance sheets and recovering dividends. The five supermajors – Exxon, Chevron, Shell, BP and TotalEnergies – reported record earnings towards the end of 2021 and generated more cash than at any time since the Great Recession. The companies reported free cash flow of about a combined $29 billion in the third quarter alone, with strong demand for crude, surging prices for natural gas and chemicals and a rebound in the refining business were probably the main drivers.

In 2022, analysts expect 30.2% profit growth for energy firms year-over-year, outpacing the broad market’s 7.5% increase, according to earnings tracker Refinitiv. Energy stocks are also cheap. The S&P 500 energy sector currently trades at around 12 times estimates 2022 earnings, as compared with a price-to-earnings ratio of 21 for the broader market.

A&J are invested in this sector via the Guinness Global Energy fund, a specialist fund with the majority of its exposure in the oil and gas sector. Run by industry veteran Tim Guinness, the fund uses proprietary models to forecast commodity process, through looking at supply and demand dynamicsfor oil, the behaviour of OPEC, and the global markets for LNG (liquified natural gas) and coal. This analysis is then used by the team to decide weightings to energy subsectors. Individual stocks are then chosen based on a number of metrics such as financial strength, recent price momentum and history, and qualitative due diligence including meetings with senior company management. The resulting portfolio is concentrated in 30 stocks with equal weightings. Currently, the fund favours integrated oil and gas companies with a focus on exploration.

Disclaimer:

The opinions expressed in this update are those of A&J Wealth Management Limited only, as at 31st December 2021, and are subject to change.

The content of this publication is for information purposes and should not be treated as a forecast, research or advice to buy or sell any particular investment or to adopt any investment strategy. It does not provide personal advice based on an assessment of your own circumstances. Any views expressed are based on information received from a variety of sources which we believe to be reliable but are not guaranteed as to accuracy or completeness. Any expressions of opinion are subject to change without notice.

The tax treatment depends on your individual circumstances and may be subject to change in future.

Past performance is not a reliable indicator of future results. Investing involves risk and the value of investments, and the income from them, may fall as well as rise and are not guaranteed. Investors may not get back the original amount invested.

In addition to statements provided by A&J, you will receive regular account valuations from your product provider which should be read in conjunction with our reports and will include further details such as fees and transactions. You will also receive information about your plan annually with itemised charges. A more detailed breakdown of fees can be provided upon request, where relevant.